|

Source: Reuters |

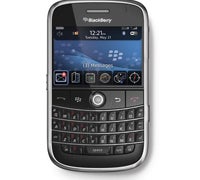

Research In Motion’s (NASDAQ: RIMM) BlackBerry may be poised to have its best corporate sales quarter yet as IT leaders are shelling out big-time for the device despite tightening budgets.

A new study released today from ChangeWave Research indicates RIM’s popular e-mail handset is taking deeper root than ever before. The study predicts it will attain 82 percent market share by the end of September, a spike that represents a five-point jump from last quarter.

Yet, at the same time, it’s pretty clear IT budget constraints aren’t loosening up anytime soon, though spending appears to be stabilizing.

“The story is that BlackBerry clearly has great momentum in the corporate space while IT spend is still soft and there’s no ‘V’[-shaped] recovery in view,” Paul Carton, ChangeWave’s research director, told InternetNews.com.

According to the survey, just 11 percent of IT organizations are spending more than initially expected this quarter, with 27 percent spending less than planned.

While the numbers aren’t encouraging, there is a bright side.

“The good news is that it’s not getting any worse,” Carton said. “We’re muddling at this point, and at best, the recovery will come in the fourth quarter.”

Already, signs are pointing to slow spending well into the second half of the year. Twenty-eight percent of IT groups polled in the study reported their IT budget for the second half of the year will be less than the first half. Just 18 percent predict spending more in the second half, while 44 percent say spending will remain the same.

While the study doesn’t investigate the categories in which spending will take place, it’s obvious that mobility is a top-budget item these days — considering RIM’s ever-growing BlackBerry adoption numbers.

As of second quarter this year, RIM held 76 percent of the smartphone market, with second-place Palm behind at 17 percent.

“RIM’s about to have one of its best quarters ever, and we’re witnessing the biggest pop in their corporate sales that we’ve ever seen,” Carton said, adding that Apple’s (NASDAQ: AAPL) iPhone has finally gained traction in the corporate space as well.

The Apple device, which is widely expected to receive a 3G update and new, corporate-friendly features, is expected to hit 13 percent market share this quarter, according to ChangeWave.

RIM, meanwhile, remains on a tear, potentially due in part to its push to get the BlackBerry into smaller and midsize businesses.

In April, it partnered with AT&T (NYSE: T) to woo small businesses to BlackBerry Professional Software, aimed at companies with up to 30 users that seek features similar to those found in BlackBerry’s enterprise offering.

Another factor may be the launch of the 3G BlackBerry Bold device, which arrived this month after much hype.