With a whole lot of news on the agenda for tomorrow and the indexes in a precarious position, it could turn out to be a pretty pivotal day for stocks.

As we’ve been saying since the low earlier this month (called quite nicely by the Demark sequential indicator), we have yet to see the kind of forceful buying that could cement a major bottom, leaving the market vulnerable to continued volatility and a potential retest of the lows.

Bearish sentiment is at very market-friendly levels (the Investors Intelligence sentiment survey hit 50% bears this week for the first time since January 1995), but without strong evidence of a turn, it may get even more market-friendly.

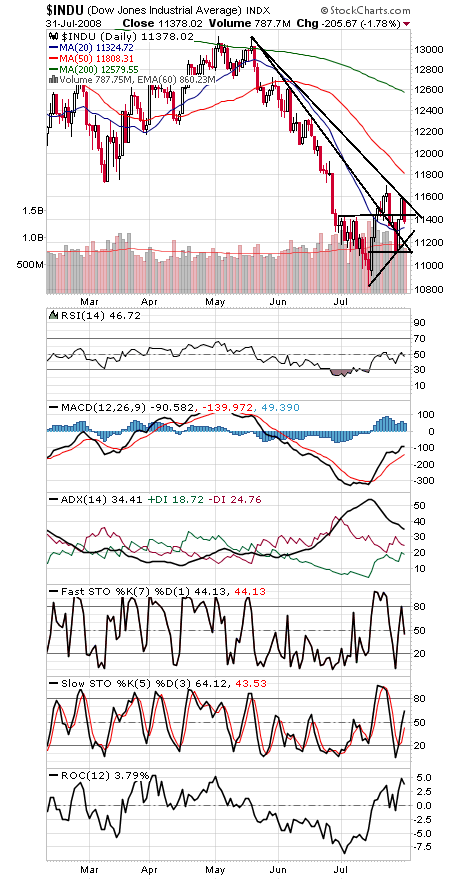

The Dow (first chart below) has support at 11,325, 11,175 and 11,123, and resistance is 11,440, 11,550-11,586 and 11,731-11,750.

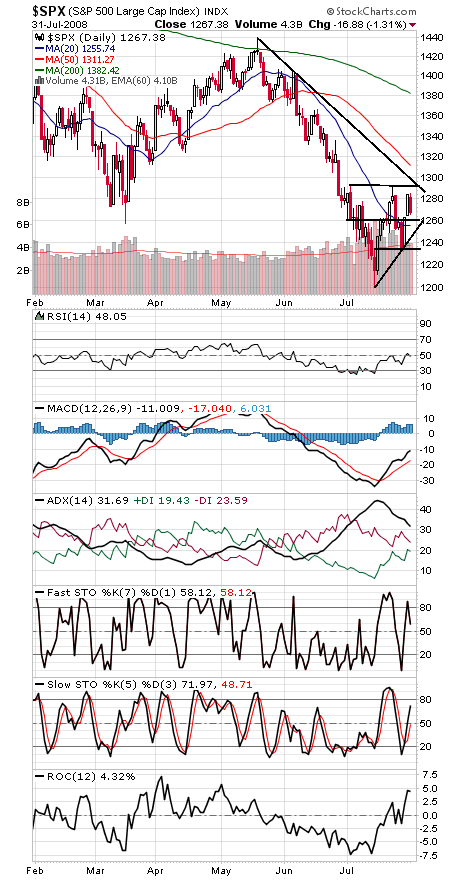

The S&P (second chart) has support at 1257-1260, 1249 and 1234, and resistance is 1285 and 1292-1295.

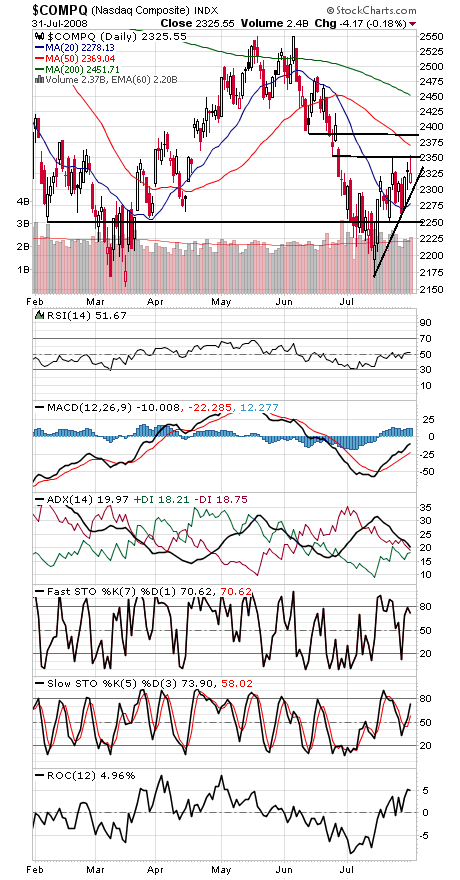

2350 is turning out to be very tough resistance for the Nasdaq (third chart), with 2365 and 2388 above that. Support is 2305, 2280 and 2250.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.