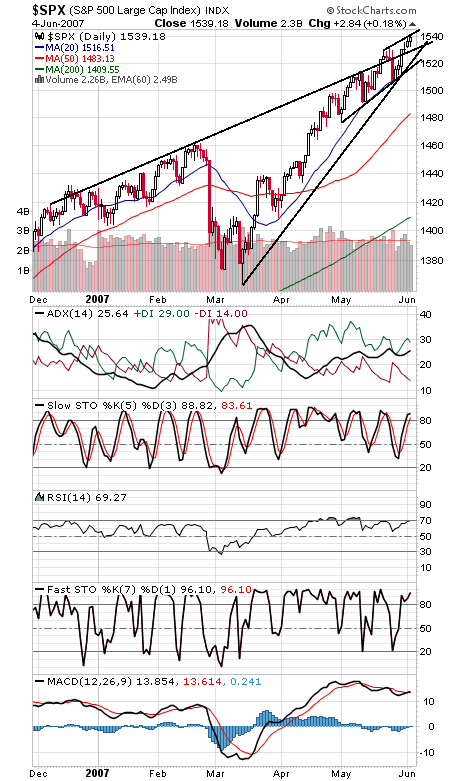

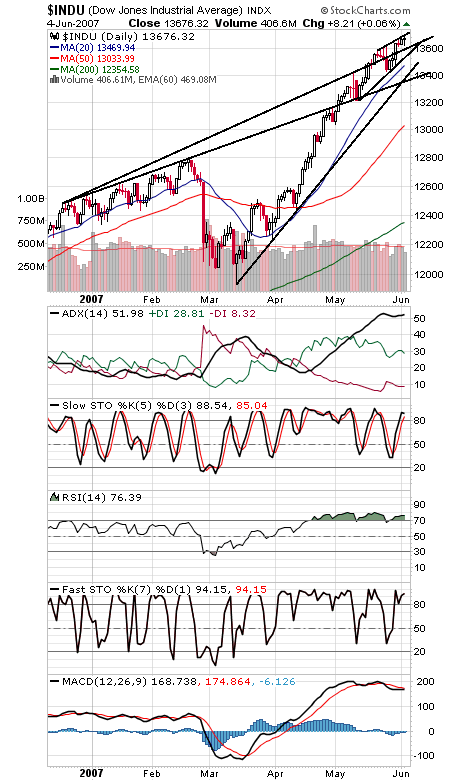

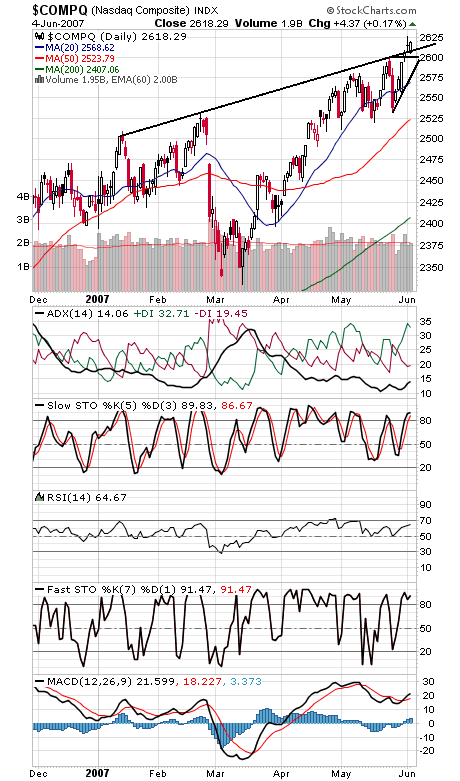

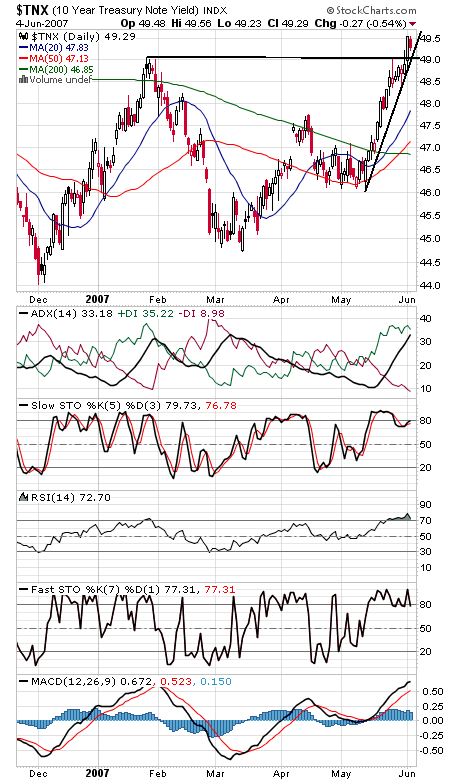

An impressive showing by U.S. markets the last couple of days, finishing with modest gains under the same conditions — a sell-off in Chinese stocks — that threatened the bull market in February. Commercial futures traders took some profits in the big S&P futures contract last week and added to the short side, but those positions will still take some time to unwind. In general, sentiment and seasonality should remain favorable for another month or two. The S&P (first chart below) remains stuck below its all-time intraday high of 1552.87, a big hurdle for the market here. The market will remain vulnerable until the index can clear that level with some strength. First resistance is 1543, and support is 1532, 1527, 1524 and 1520. The Dow (second chart) faces resistance at 13,700, and support is 13,600 and 13,550. The Nasdaq (third chart) has broken out nicely in the last couple of days. 2626 is first resistance, and support is 2610 and 2600. The 10-year yield (fourth chart) remains stuck just below 5%. Yields are also looking a little extended here, with -DI slipping below 10.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association