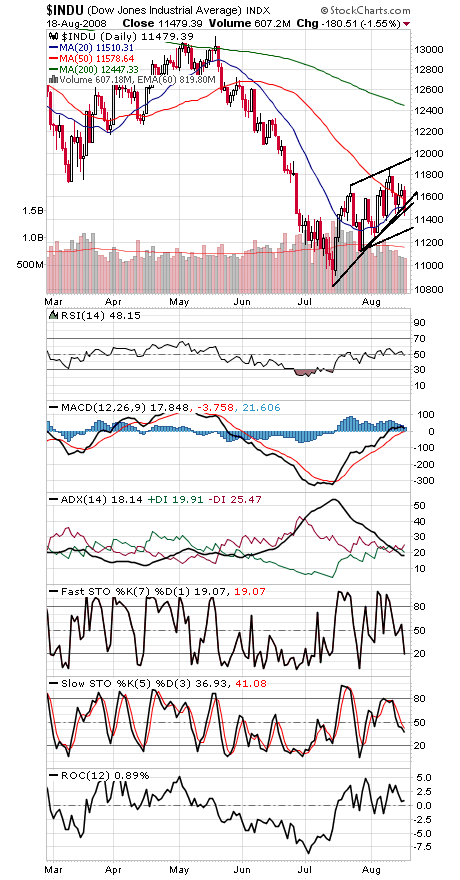

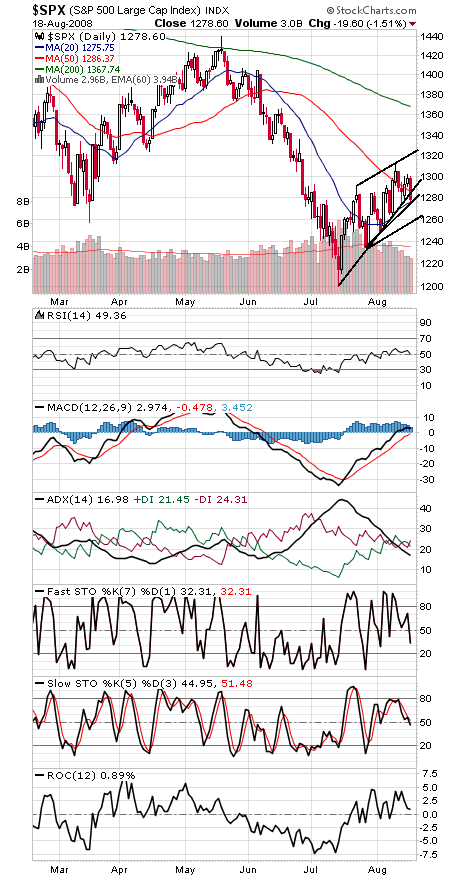

Today was a clear loss for the bulls, as the Dow and S&P (first two charts below) gave up their month-old uptrends today.

The next support levels for the Dow are 11,400 and 11,320, and the index needs to get back above 11,580 to reverse the breakdown.

The S&P could be okay if it reverse right at the open tomorrow; otherwise 1260 could be the next target. To the upside, a move above 1290 would be an important beginning.

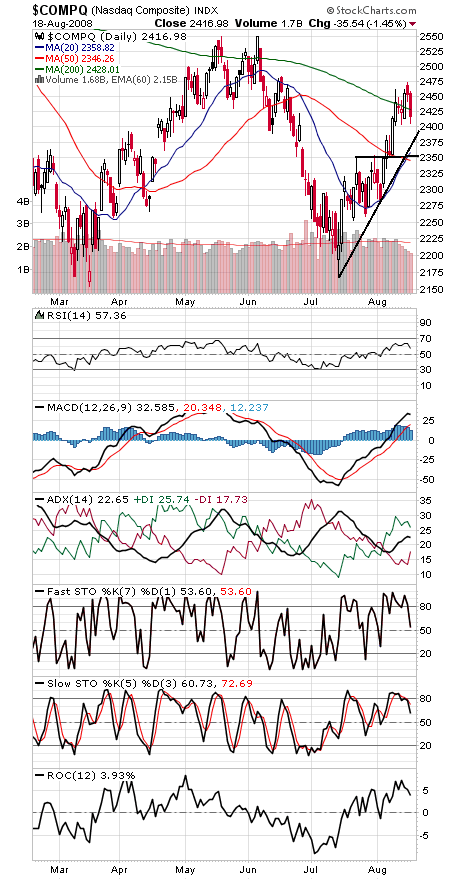

The Nasdaq (third chart) continues to hold up much better than its blue chip counterparts, a trend that has been going on since March. But it’s unlikely that the sector will be able to withstand blue chip weakness forever.

The Nasdaq’s main support is at 2380, while 2475-2500 is proving tough resistance for the index.

In short, while we’ve had plenty of excess bearish sentiment and oversold conditions for a major bottom, we continue to lack the buying stampede that could signal a new bull trend. The time for that all-clear signal is passing and suggests a longer-term technical problem for the market, leaving it potentially vulnerable to a retest of the lows or stuck in a long-term trading range.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.