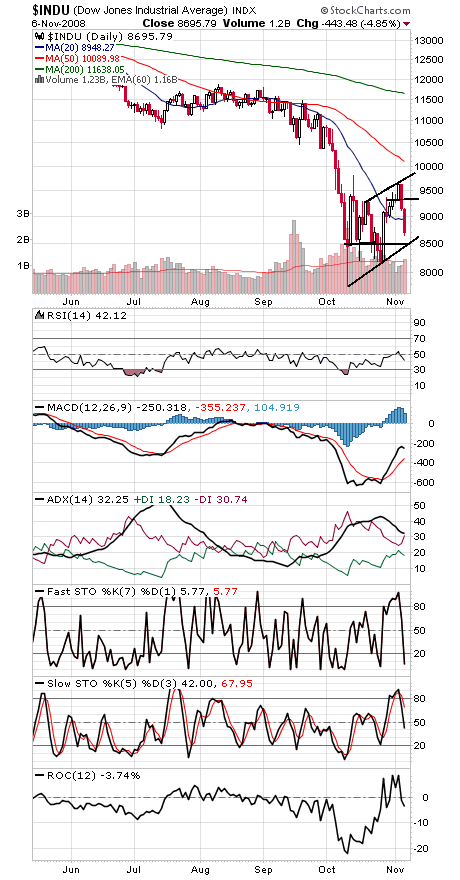

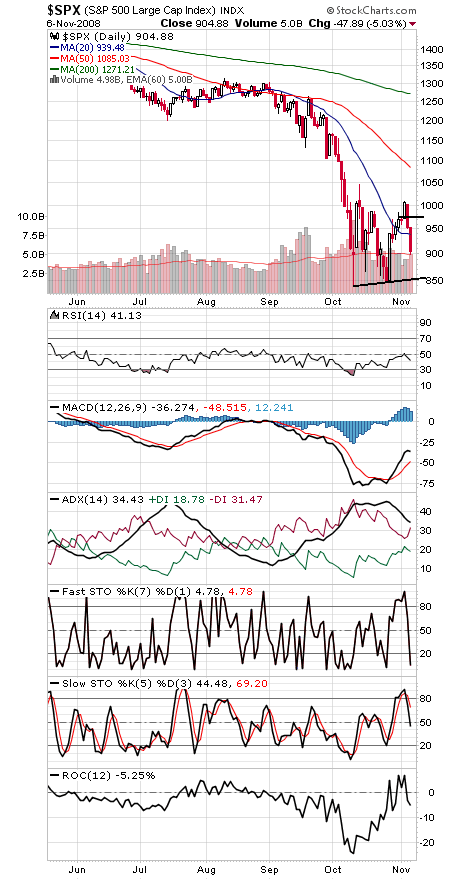

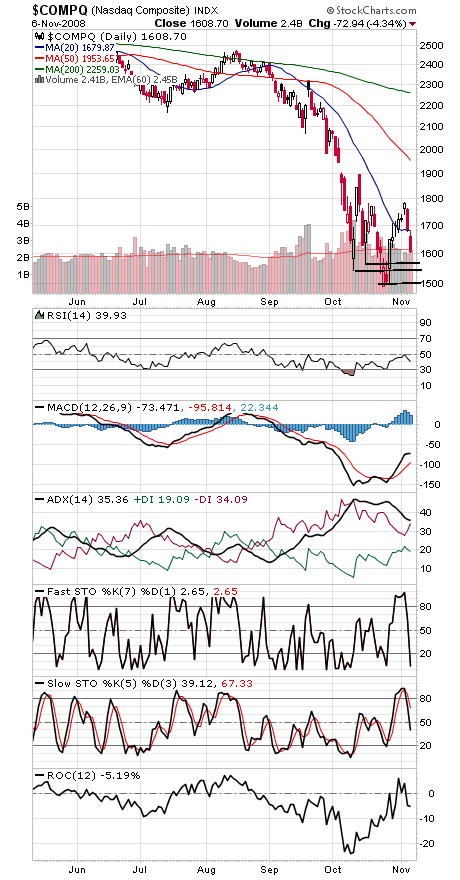

We said the stock market looked like traders might “sell the news” after the election, but not before a big head fake up. That often occurs on the final move of a wedge or ending diagonal, an “overthrow” that fools traders before the pattern breaks in the predicted direction.

Now that momentum appears to have turned down once again, where will the selling stop? About the only good news is that we’re not far from major support, so we should know soon if we’ve begun another wave down.

The closing lows of 849 on the S&P, 8176 on the Dow and 1506 on the Nasdaq would be ideal places to hold, although there are some obvious first support levels at 875 on the S&P, 8500 on the Dow, and 1584, 1575, 1565, 1552 and 1540 on the Nasdaq. 8500 on the Dow looks particularly important, since the index has the potential to form an uptrend if it holds.

To the upside, 9000 and 9324 are levels to beat on the Dow, 950-953 and 966-971 on the S&P, and 1680 on the Nasdaq.

And on a speculative note, the most common Elliott wave view of the market here is that the indexes have been in a large Wave 4 correction in a downtrend since the October 10 low, which could mean another wave down to new lows — to be followed by a strong rally, if not a new bull market. A potential pattern to keep an eye on.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.